36+ Student finance repayment calculator

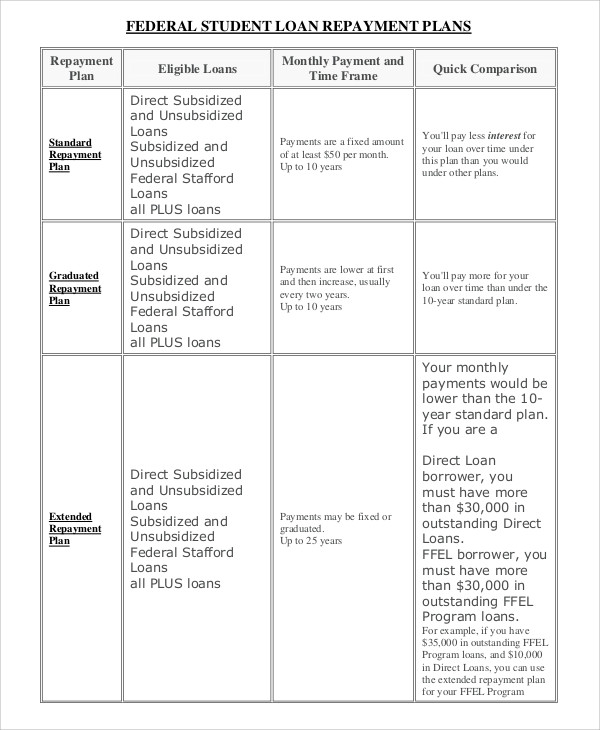

But you may decide your current offer meets your needs. SoFi refinance loans are private loans and do not have the same repayment options that the federal loan program offers or may become available such as Income Based Repayment or Income Contingent Repayment or PAYE.

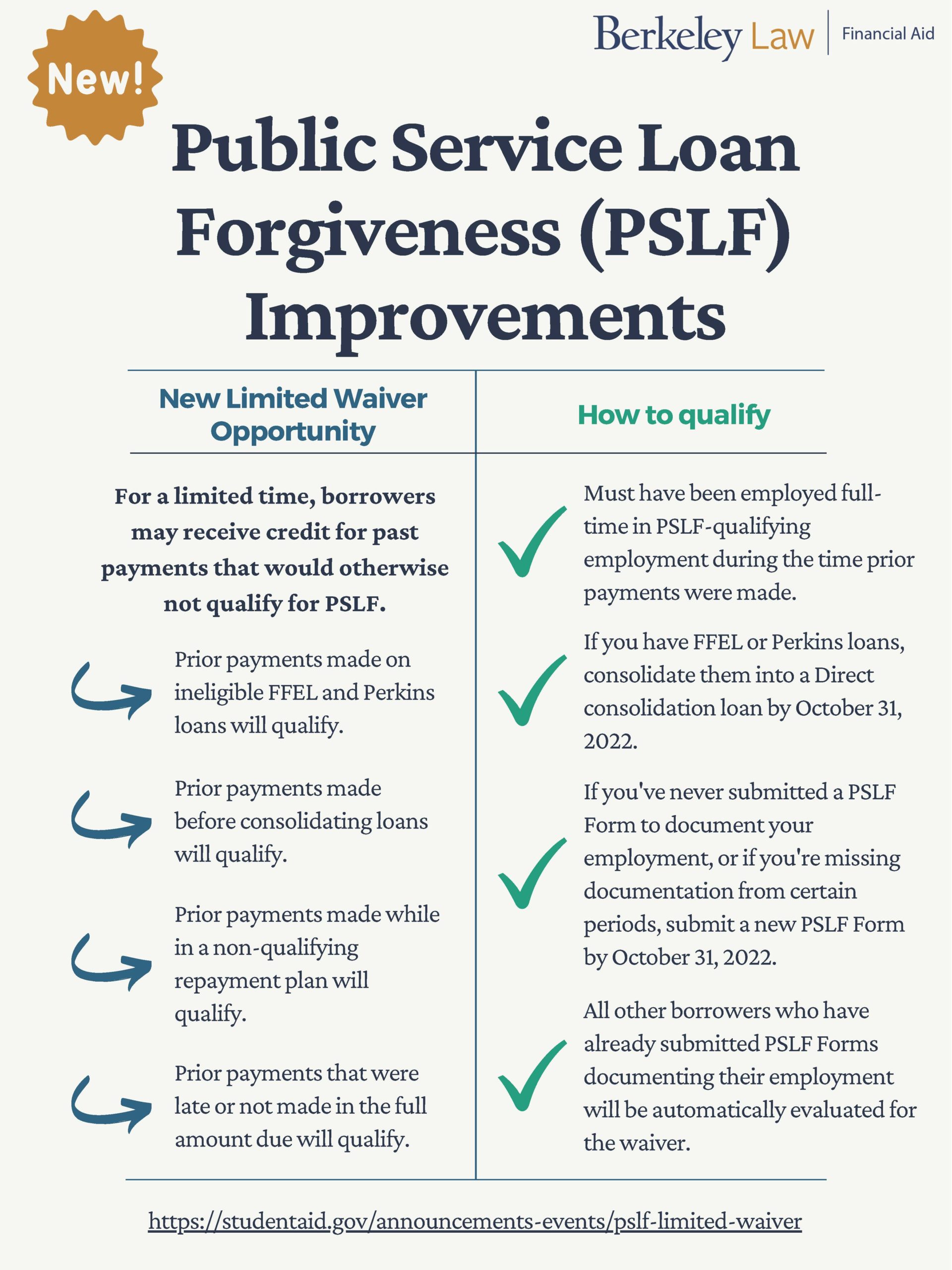

News Updates Berkeley Law

10000 to 100 total cost of attendance.

. To meet the 20000 of need Student A is offered 3500 in Subsidized Stafford Loans and 2000 in Unsubsidized Loans while the parents are offered a PLUS Loan of 2500. But to be safe most conventional lender prefer a back-end DTI ratio no higher than 36. This means that subprime borrowers people with scores between 580 and 619 also referred to as poor credit have a chance at.

Rates are influenced by the economy your credit score and loan type. Borrowers with a solid financial history. Jake Butler Save the Students Student Finance expert.

Between the two DTI ratios most lenders regard back-end DTI with more weight. Between 2009 and June 2022 the average student loan balance held by US. Please call our finance team to discuss your options.

Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. 6 to 30 characters long. After 13 years of student loan payments a 36-year-old public school teacher finally got 47000 forgiven thanks to an app Leo Aquino CEPF 2022-08-27T122500Z.

Use our mortgage repayment calculator to work out what your repayments will be based on how much youre borrowing the interest rate and fees of the deal and the term of the mortgage how long you have to pay it off. Student loan refinancing. Must contain at least 4 different symbols.

It is highly unlikely that any lender will consider a loan if your only income is a grant or a regular allowance from your family. The actual rate you will qualify for depends on your credit. 5 to 15 years.

What will my loan cost. Second mortgages come in two main forms home equity loans and home equity lines of credit. Borrowers must maintain a back-end DTI no higher than 43 to obtain a qualifying mortgage.

Credit scores with 580 or above will only be required to have a deposit of 35 percent. FHA will finance with a 500 to 589 credit score and 10 percent down Sexton says. Debt consolidation loans typically have interest rates from 6 percent to 36 percent.

It can take up to 6 weeks to process your application. Can perform any time value of money calculation. LendingTree is a marketplace of about 40 lenders where you can compare rates for a wide variety of financial products including auto refinance loans.

Student loan calculator. If youre a current student on an existing scholarship or tuition agreement it is also available to you but you may decide your current offer meets your needs. Youll need to create a student finance account if youre a new student or sign into an existing account if youre a returning student.

Second mortgage types Lump sum. Comparison of Education Advancement Opportunities for Low-Income Rural vs. Helps you see how much you will pay monthly on your loan mortgage personal student or any type over a defined period of time with a fixed interest rate.

A mortgage is a major financial commitment so youll need to have a good idea of how much its going to cost you each month. It includes credit card payments auto loans and student loans etc. This was exactly what I needed.

Student As parents can contribute 30000 per year toward the 50000 cost of tuition and living. Car finance is a form of finance to purchase a car. Mortgage loan basics Basic concepts and legal regulation.

Get the latest financial news headlines and analysis from CBS MoneyWatch. Creditor Insurance for CIBC Personal Lines of Credit underwritten by The Canada Life Assurance Company Canada Life can help pay off or reduce your balance in the event of death or cover payments in. Its important for you to work out what your loan will cost you in terms of monthly repayments over the term.

A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. Actual results and loan or line of credit payment amounts and repayment schedules may vary. Total program length in credits 36.

Actual rate and available repayment terms will vary based on your income. Minimum credit history of 36 months. Lets consider Student A and Student B again to illustrate this.

Thank you so much. ASCII characters only characters found on a standard US keyboard. Fixed rates range from 347 APR to 1349 APR excludes 025 Auto Pay discount.

Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially granted. Personal loans can also be used for student loan refinancing purposes. SoFi student loans are originated by SoFi Bank NA.

Student Loan repayments come with weekly and monthly thresholds too. Do I get to keep the same. This means that even if you have a salary that falls below the annual threshold receiving a bonus or completing extra shifts could mean you end up crossing the.

As a student it is likely that your only income is from part-time employment so your loan will be judged on this. The median household income had grown from 49777 to 67521 or about 36 not adjusting for inflation. Learn how student loan debt has increased by looking at our proprietary data that weve collected since 2009.

Calculator assumes a constant rate of interest. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. The companys marketplace covers the full spectrum of credit scores.

The average mortgage interest rate is around 55 for a 30-year fixed mortgage. Consumers grew about 92 from 20560 to 39381. Whether youre looking to take a 5000 loan or even 15000 our loans calculator can help you work out how much you can afford to borrow by entering how much you can afford to pay back each month and the length of time you can afford to pay that.

Urban High School Student. Education Loan Finance. Student loans usually have high interest rates ranging from 6 and up and using a personal loan to pay off student loans will translate to lower interest rates and faster debt repayments.

Finding the present value PV future value FV annuity payment PMT interest rate or no.

Tracking Your Debt Goals Loan Payoff Student Loans Student Loan Payment

Debt Payoff Calculator Spreadsheet Debt Snowball Excel Etsy Credit Card Debt Payoff Saving Money Budget Money Saving Plan

Download The Simple Interest Loan Calculator From Vertex42 Com Amortization Schedule Mortgage Amortization Calculator Simple Interest

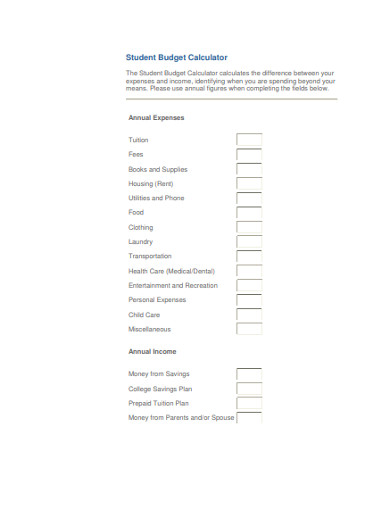

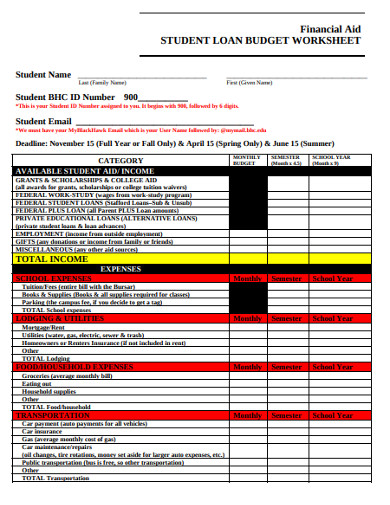

Student Budget Examples 18 Templates Download Now Examples

Pin On Money

Updated Idr Waiver Summary With Faq R Pslf

107 Ways To Pay Off Your Student Loans Student Loan Planner

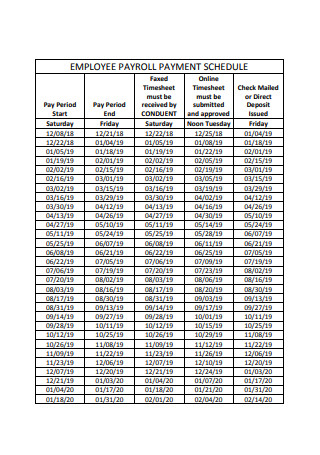

36 Sample Employee Payrolls In Pdf Ms Word

9 Ways Student Loans Impact Your Credit Score Ksl Com Paying Off Student Loans Student Loan Debt Student Loan Repayment

Home Loan Comparison Spreadsheet Amortization Schedule Mortgage Amortization Calculator Loan Calculator

Home Loan Home Loans Debt Relief Programs Home Improvement Loans

Student Budget Examples 18 Templates Download Now Examples

22 Payment Plan Templates Word Pdf Free Premium Templates

Student Loan Payoff Tracker Printable Pdf Loan Payoff Student Loans Student Loan Forgiveness

Pin On Get Yo Shit Together

Here S How To Pay Your Car Loan Emi On Time Without Straining Your Budget Car Loans Car Payment Calculator Car Loan Calculator

Loan Early Payoff Calculator Excel Spreadsheet Extra Etsy Loan Payoff Debt Calculator Student Loans